Summary

- BNPL is quick and easy, but lenders face risks due to increasing amounts spent and the need for fast evaluation — $176B is expected to increase.

- BNPL applications involve extensive background processes such as ID checks, facial recognition, device risk, and bank account verification.

- Your data is utilized for BNPL applications but should not be a concern if used responsibly; companies will likely offer deals based on buying patterns.

Buy now, pay later (BNPL) is great. It only takes a minute to set up your account on the app, and there you go. You can afford the nice stuff you want, because you can pay for it over four months. As long as you keep up the payments, it is an easy, interest-free loan. This is true.

BNPL is also great, and because it is so quick, you’re only dipping your toe in the credit swimming pool. Nobody knows you’re doing it, and as long as you pay on time, nobody cares. The deal is between you and the app, and it stops there. Right? Nope, wrong.

The moment you start talking to the app, you go into the system. And you stay there. Let me tell you what happens in that minute it takes to open a BNPL account.

This is not about knocking BNPL or the people who use it to buy what they want when money is short right then. It is also not about the Fintech companies behind the apps you would use to open an account, or the credit bureaus they use to verify your details during the application. I am simply explaining that you are not just dipping your toe in, you are diving head-first into the water. By the time you have your BNPL account, your details have been around the world, have been looked at, analyzed, run through several databases, and added to a few more. Nobody will really mess with your details. I’m just telling you to give you all the fine print.

Why BNPL is so quick

Small amounts, low risk?

Most users think, because BNPL involves small amounts over a short time, the risk is low, and that is why the process is so quick. The reality is that for the lenders, the risk lies in the $176 billion dollars currently spent on BNPL, and the collective risky behavior of the total number of people using these loans.

Saying yes to massive trade

The $176 billion spent on BNPL is expected to balloon to $380 billion in 2030, and that’s just too much money to say no to. But 10% bad debt of $176 billion today is $17.6 billion, so the trick is to evaluate new BNPL clients thoroughly to bring the risk down. But the valuation has to happen very quickly, otherwise those customers are one click and gone.

Friction and the need for speed

Most BNPL transactions — 70 to 80% — happen online, and online is the wild west in retail terms. If the fintechs doing the BNPL applications could take their time, they would. But anything longer than a minute or two is too long, and the customer will click away to someone else.

The 90% of good debt in the example above is $158 billion, and who will let that slip through their fingers? The hassle and time it takes to transact online is called friction in the trade, and the amount of friction an online client is willing to tolerate is very low. One click.

How BNPL happens so quickly

All at once, all in the background

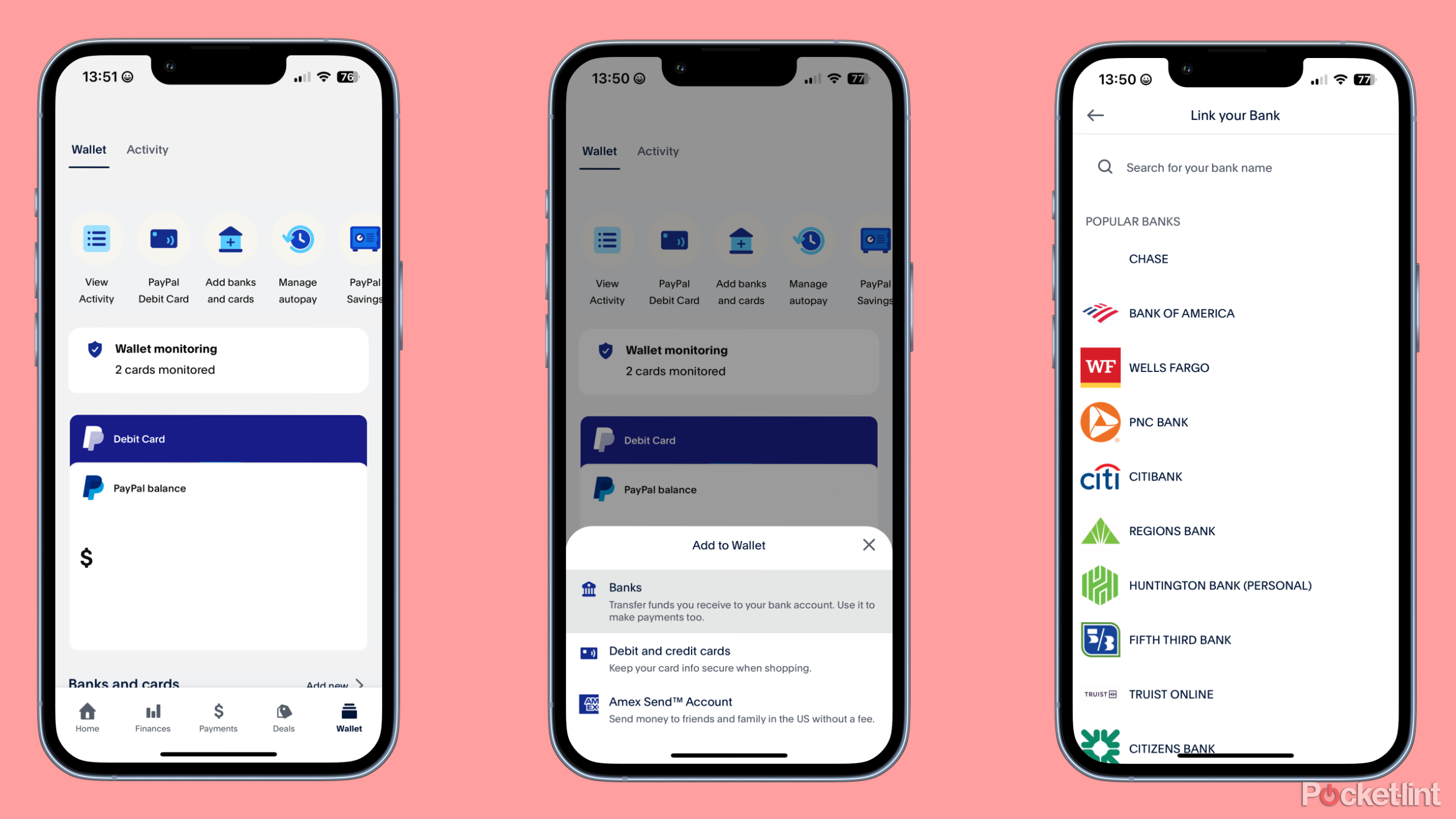

When you apply for BNPL, you have to provide ID, a driver’s license or passport, as well as a credit card or bank account details. You may be asked for a selfie where you do something like touch your ear, but that is just to guard against deep fakes. The rest of the stuff happens simultaneously, very quickly, and in the background. You won’t even know about it, unless your details get flagged.

Identity document

An optical character reader is used to extract all the information from the identity document you provide and this is run against vast identity databases. It will immediately pick up if you are you, and if you have been naughty or nice. If nice, you will go on a new database for BNPL applicants whose ID checks out. Data is gold, and they never throw anything away.

The information on the datasets will also be used to prefill your application form to reduce manual errors and speed up the process.

Identity photo

Nobody looks like their driver’s license picture, but facial recognition measures your facial features and the size, distance, and relationship between your eyes, or eyes and ears and nose. The resulting digital compilation identifies your facial features as uniquely as a fingerprint, and this digital ‘faceprint’ is sent through other databases to check for suspicious matches. If it’s good, it’s cool — but your face will still sit in a database of good faces.

Device risk

All online transactions, including BNPL applications, involve the use of a device — your phone, tablet, or computer. Each device has a unique signature, and no, anonymous VPNs will not work. Your device will be identified and run through more databases and other diagnostics to check if it has ever been stolen, involved in fraud or illegal activities, bad loans, or crimes like money laundering.

Changes such as SIM swapping will be picked up, and your geolocation will be verified. Once verified, your device will join your identity on a database in the cloud somewhere.

Bank account

Your banking details will be verified to make sure they are linked to your identity. While they are at it, it will most likely also be run through other databases to check for suspicious transactions, other bank accounts linked to your ID, and so on.

Other accounts and loans

BNPL is currently seen as a soft credit check, which means it won’t affect your credit record as things stand. That will probably change later in the year, but your details will nonetheless be run through the BNPL datasets to see how many other such loans you currently have and how these may affect the affordability of your application.

No need to worry yet

Your data is out there, anyway

If you plan on staying financially sound and on the right side of the law, none of the stuff described above should concern you. Credit bureaus are discreet and will probably not sell your data. The fintechs who run the BNPL apps will use your data and buying patterns to inform you of deals you can take advantage of, but this is described on their websites, and you can probably opt out if you wish.

Using BNPL

As long as you use BNPL responsibly, it’s a good way to buy goods that would otherwise be beyond your budget. The companies involved are generally fairly responsible in their actions, although they will probably encourage you to spend more if they think your finances can handle it. So stay smart, be safe. A little bit of paranoia is not necessarily a bad thing.

Trending Products

ASUS 22â (21.45â viewable...

Thermaltake Tower 500 Vertical Mid-...

HP 330 Wireless Keyboard and Mouse ...

HP 24mh FHD Computer Monitor with 2...

ASUS Vivobook Go 15.6â FHD Sli...

Acer Aspire 5 15 Slim Laptop | 15.6...

HP 27h Full HD Monitor – Diag...

HP 15.6″ Portable Laptop (Inc...